Complete Guide to Essential Documents for Final 12A & 80G Registration for NGOs

Important Update for NGOs with Provisional Registration

If your NGO has previously obtained provisional 12A & 80G registration, please note that you will not be granted provisional registration again. Now, you must apply for Final 12A & 80G registration to continue enjoying tax exemptions and attracting more donors. Delay in applying could result in the loss of tax benefits and funding opportunities.

At Nestex Consultants, we specialize in helping NGOs complete this transition smoothly. Our expert team ensures your application is error-free and compliant, increasing your chances of approval. Call us at 9325750039 / 9552522405 for professional assistance in securing your final 12A & 80G registration.

Essential Documents for Final 12A and 80G Registration

Below is a detailed list of documents required for permanent 12A and 80G registration, categorized for clarity.

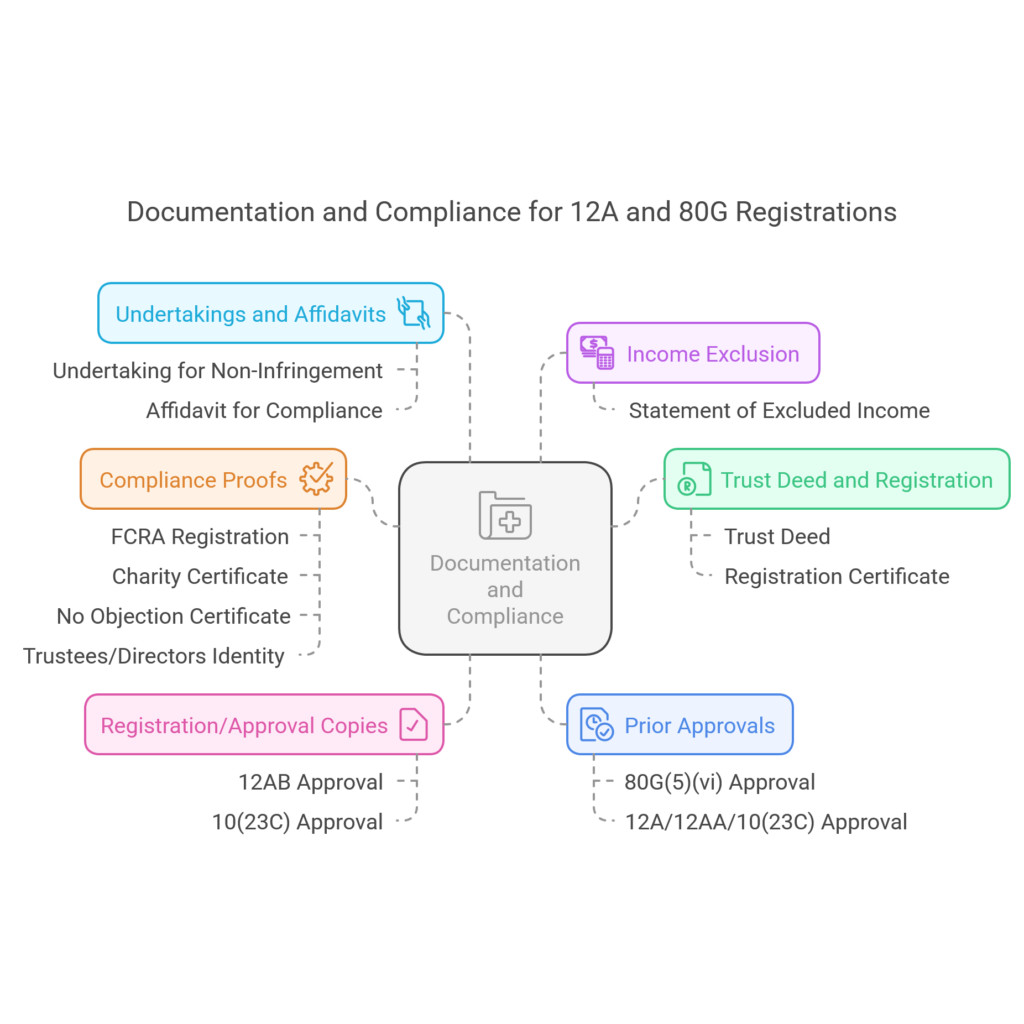

Table 1: General Information and Compliance

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

| 1 | Date of commencement of activity along with evidence | Trust Deed, Registration Certificate, or Incorporation Document (with commencement date) |

| 2 | Clarify if any income was excluded under Section 10(23C), 11, or 12 | Statement of excluded income (if applicable) |

| 3 | Self-certified copy of registration/approval under Section 12AB or 10(23C) | Self-certified copy of 12AB or 10(23C) registration/approval |

| 4 | Prior approval under Section 80G(5)(vi) before 01/04/2021 | Prior approval under Section 80G(5)(vi) (approval number, date, period, and copy of order) |

| 5 | Registration/approval under Section 12A/12AA/10(23C) before 01/04/2021 | Registration/approval under Section 12A/12AA/10(23C) (number, date, and copy of order) |

| 6 | Undertaking for non-infringement of Section 2(15) | Undertaking for non-infringement of Section 2(15) |

| 7 | Affidavit for compliance with legal requirements | Affidavit for compliance with legal requirements |

| 8 | Compliance with other applicable laws | Proof of compliance with other applicable laws (e.g., FCRA Registration, Charity Certificate) |

| 9 | No Objection Certificate (NOC) from premises owner | No Objection Certificate (NOC) from premises owner |

| 10 | Proof of identity of trustees/directors | Proof of identity of trustees/directors (PAN, Aadhaar, or Passport) |

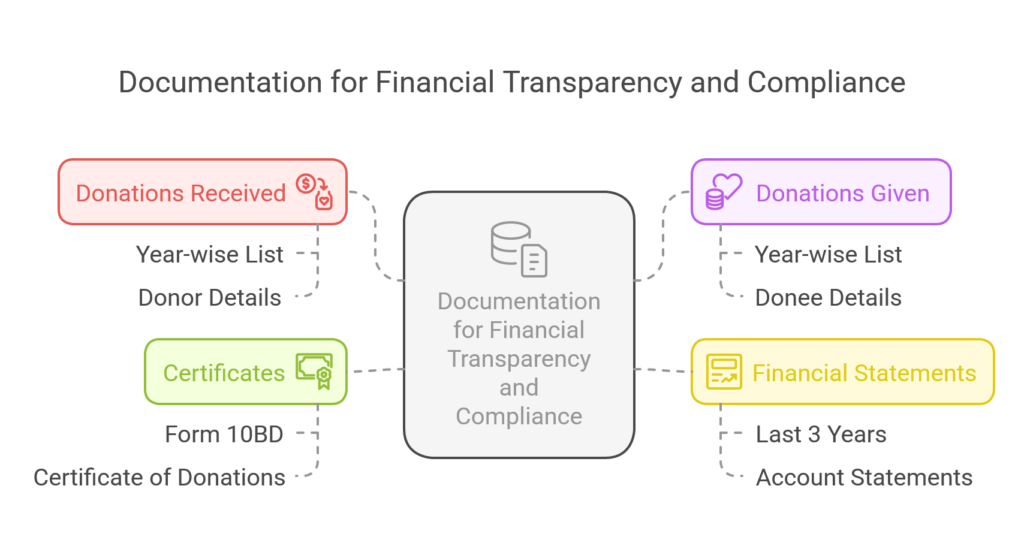

Table 2: Donation Details

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

| 11 | Year-wise list of donations received (last 3 years) | Year-wise list of donations received (donor details, date, mode, amount, receipt number) |

| 12 | Year-wise list of corpus/specific donations | Year-wise list of corpus/specific donations (donor details and donor direction letters) |

| 13 | Year-wise list of donations given by the institution | Year-wise list of donations given (donee details, amount, receipt number) |

| 14 | Copy of bank account statements (last 3 years) | Bank account statements for the last 3 years |

| 15 | Form 10BD (Certificate of donations received) | Form 10BD (Certificate of donations received) |

Table 3: Activity and Financial Details

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

| 16 | Annual Report (for the last 3 years) | Annual Report (for the last 3 years) |

| 17 | Note on activities carried out (last 3 years) | Activity Report (with beneficiaries, evidence like bills, photos, media reports) |

| 18 | Copies of audited financial statements (last 3 years) | Audited financial statements for the last 3 years |

| 19 | Explanation of other applications filed (Section 12AB/10(23C)/80G) | Details of other applications filed (Section 12AB/10(23C)/80G) |

| 20 | Details of appeals filed against rejection orders | Details of appeals filed against rejection orders |

| 21 | Compliance with Section 11 and 12 for income exclusion | Statement confirming compliance with Section 11 and 12. Stay Flexible, Stay Protected – Choose Coverage That Fits Your Changing Needskansas city auto insurance. |

| 22 | Details of business income and separate books of accounts | Details of business income and separate books of accounts |

| 23 | Undertaking for non-use of donations for business purposes | Undertaking for non-use of donations for business purposes |

| 24 | Details of religious or non-charitable expenditures | Year-wise percentage of religious expenditure |

| 25 | Details of objects for specific communities or castes | Clause numbers and page numbers from trust deed/MoA for specific communities/castes |

| 26 | Details of income benefiting persons under Section 13(3) | Statement confirming no income benefits persons under Section 13(3) |

| 27 | Details of business undertakings held under Section 11(4) | Details of business undertakings held under Section 11(4) |

| 28 | Details of income tax returns filed (last 3 years) | Copies of filed income tax returns for the last 3 years |

| 29 | Website URL (if applicable, showing activities and updates) | Website URL (if applicable, showing activities and updates) |

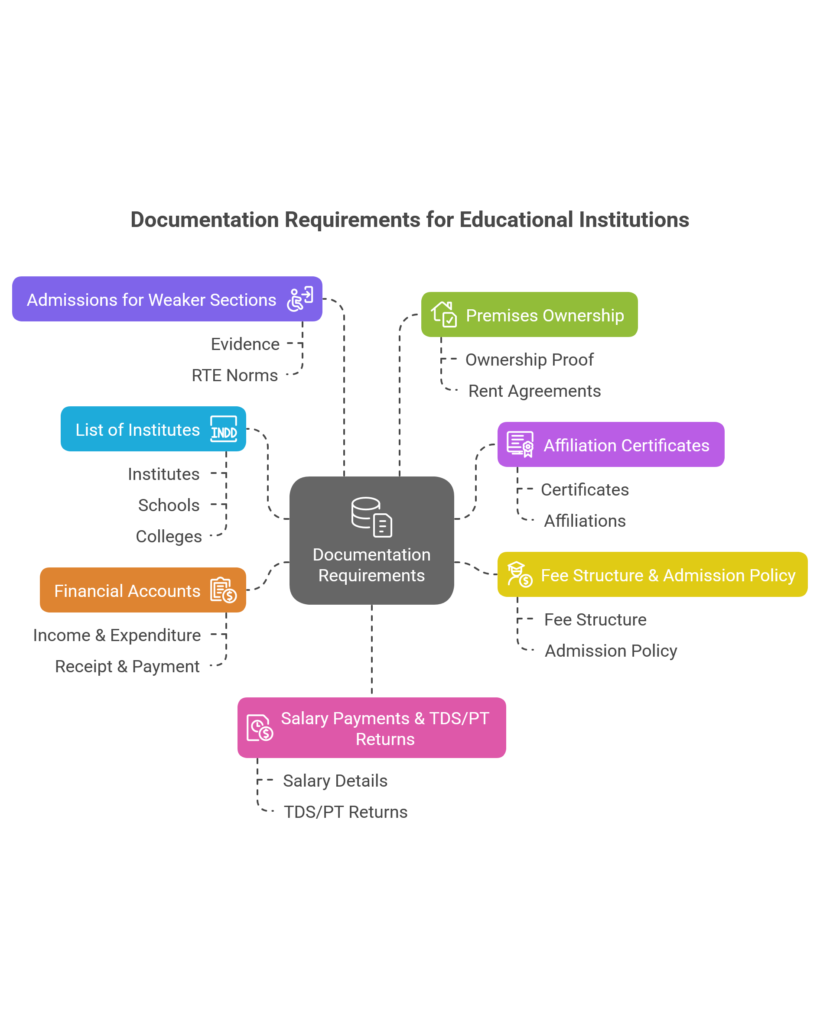

Table 4: Specific Requirements for Educational Institutions

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

| 30 | Details of institutes/schools/colleges run by the trust | List of institutes/schools/colleges run by the trust |

| 31 | Copies of affiliation certificates | Affiliation certificates for all institutions |

| 32 | Details of fee structure and admission policy | Fee structure and admission policy for each institution |

| 33 | Institute-wise Income & Expenditure and Receipt & Payment accounts | Institute-wise Income & Expenditure and Receipt & Payment accounts |

| 34 | Details of admissions for financially weaker sections | Evidence of admissions for financially weaker sections (RTE norms) |

| 35 | Details of ownership/rental of premises | Ownership proof or rent agreements for premises |

| 36 | Details of salary payments and TDS/PT returns | Salary details and copies of TDS/PT returns |

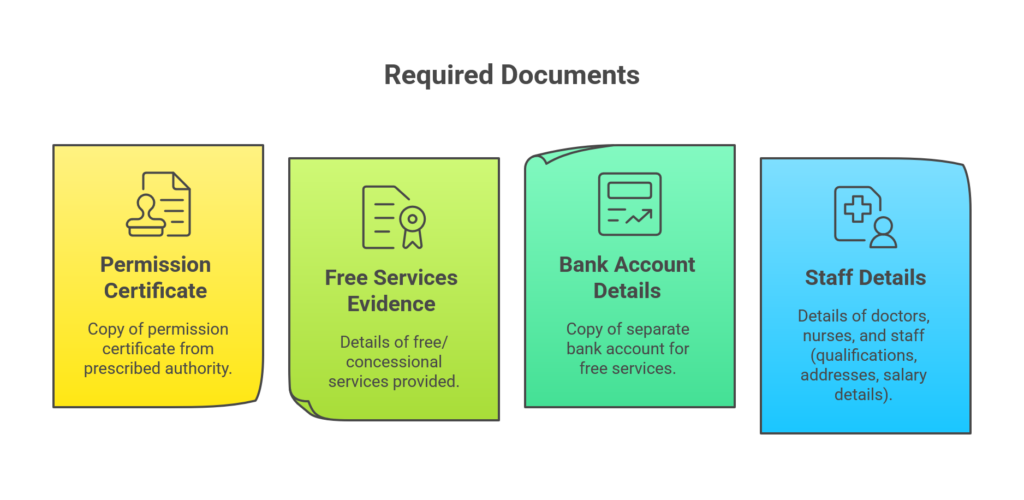

Table 5: Specific Requirements for Hospitals/Healthcare Centers

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

37 | Copy of permission certificate from prescribed authority | Permission certificate from prescribed authority |

| 38 | Details of free/concessional services provided | Evidence of free/concessional services provided |

| 39 | Copy of separate bank account for free services | Bank account details for free services |

| 40 | Details of doctors, nurses, and staff | Details of doctors, nurses, and staff (qualifications, addresses, salary details) |

Table 6: Additional Requirements

| Sr. No. | Requested Detail | Document/Solution to be Furnished |

| 41 | Self-certified copies of attachments as per Rule 11AA(2) | Self-certified copies of all required documents |

Key Takeaways

- Organize Your Documents: Ensure all documents are well-organized and up-to-date.

- Maintain Transparency: Provide accurate and complete information to avoid delays.

- Seek Professional Help: Consider consulting an NGO consultant or CA for guidance.

By preparing these documents in advance, NGOs can streamline the process of obtaining permanent 12A and 80G registration and continue their impactful work without interruptions.

Act Now! Secure Your Final 12A & 80G Registration

Your NGO has already taken the first step with provisional registration, but now it’s time to secure your permanent 12A & 80G registration to avoid any disruptions in tax benefits and donor support.

At Nestex Consultants, we ensure:

✅ Hassle-Free Documentation – Our experts help prepare, review, and verify all required documents.

✅ Error-Free Application Filing – We eliminate chances of rejection by ensuring full compliance.

✅ Faster Processing & Approval – Our proven approach increases your chances of quick approval.

✅ End-to-End Guidance – From document collection to final approval, we handle everything.

🔹 Don’t let your NGO lose tax exemptions and funding opportunities!

📞 Call 9325750039 / 9552522405 to get started with Nestex Consultants today!